Navigating the Landscape of Property: A Guide to Bucks County’s Tax Map

Related Articles: Navigating the Landscape of Property: A Guide to Bucks County’s Tax Map

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Landscape of Property: A Guide to Bucks County’s Tax Map. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Landscape of Property: A Guide to Bucks County’s Tax Map

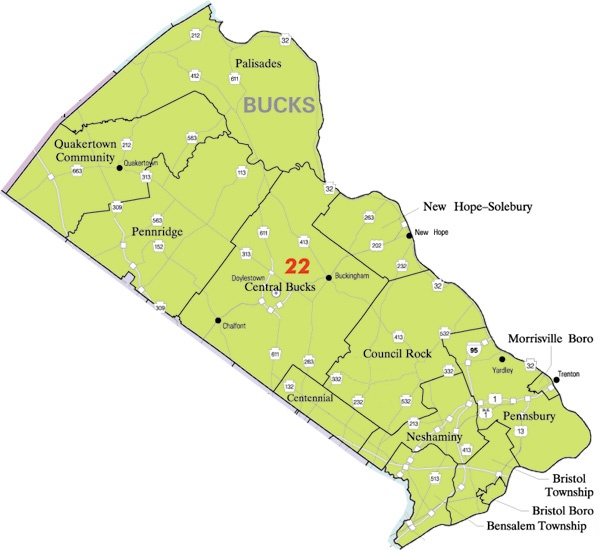

Bucks County, Pennsylvania, renowned for its picturesque landscapes and thriving communities, boasts a rich tapestry of properties. Understanding the ownership and characteristics of these properties is crucial for various stakeholders, including homeowners, prospective buyers, developers, and government agencies. This comprehensive guide delves into the intricacies of the Bucks County Tax Map, a vital tool for navigating this intricate landscape.

Understanding the Bucks County Tax Map

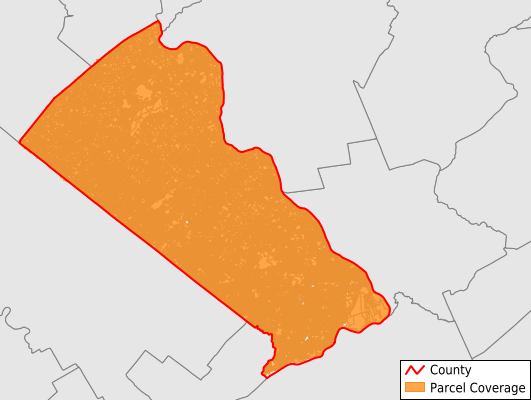

The Bucks County Tax Map, a digital and physical representation of all taxable properties within the county, serves as a foundational resource for property-related information. Its purpose extends beyond simply identifying property boundaries; it encompasses a wealth of data crucial for informed decision-making.

Key Features of the Bucks County Tax Map

- Property Identification: Each parcel of land within Bucks County is assigned a unique identification number, known as the Parcel Identification Number (PIN). This PIN acts as a primary key for accessing property details.

- Location and Boundaries: The map visually depicts the precise location of each property, clearly outlining its boundaries. This visual representation is essential for understanding property size, shape, and potential limitations.

- Ownership Information: The Bucks County Tax Map contains information about the current owner of each property, including their name and contact details. This is invaluable for property transactions, contacting owners for inquiries, and identifying potential neighbors.

- Property Characteristics: The map provides details about the property’s characteristics, such as its zoning classification, building type, and improvements. This information is vital for understanding the property’s potential use, legal restrictions, and estimated value.

- Tax Assessment Data: The Bucks County Tax Map includes information about the assessed value of each property, which forms the basis for calculating property taxes. This data allows for comparisons between properties, understanding tax burdens, and identifying potential tax appeals.

- Accessibility and Formats: The Bucks County Tax Map is readily accessible through the official website of the Bucks County Assessment Office. It is available in various formats, including online interactive maps, downloadable PDFs, and physical paper maps.

Benefits of Utilizing the Bucks County Tax Map

The Bucks County Tax Map offers a multitude of benefits for various stakeholders:

- Homeowners: The map empowers homeowners to understand the value of their property, compare it to neighboring properties, and identify potential tax appeals. It also aids in understanding zoning regulations and potential development limitations.

- Prospective Buyers: The map provides a comprehensive overview of properties for sale, allowing buyers to make informed decisions based on location, size, characteristics, and potential value. It also helps identify potential environmental concerns or legal restrictions.

- Developers: The map is an essential tool for developers, providing insights into available land, zoning regulations, and potential development restrictions. It helps identify suitable locations for projects and assess the feasibility of development plans.

- Government Agencies: The map serves as a foundation for various government operations, including property tax collection, land use planning, and emergency response. It enables efficient resource allocation and informed decision-making.

Navigating the Bucks County Tax Map: A Step-by-Step Guide

- Access the Bucks County Assessment Office website: Begin your exploration by visiting the official website of the Bucks County Assessment Office. This website serves as the central hub for accessing the tax map and related information.

- Locate the "Tax Map" or "Property Search" section: The website will typically have a dedicated section for accessing the tax map or conducting property searches.

- Input your desired search criteria: The website will provide options for searching by property address, PIN, owner name, or other relevant criteria.

- View the map and access property details: Once you have entered your search criteria, the website will display the corresponding property on the map. You can then click on the property to access detailed information about its characteristics, ownership, and tax assessment.

- Utilize additional features: The website may offer additional features, such as the ability to print maps, download data, or access historical property records.

FAQs Regarding the Bucks County Tax Map

Q: How often is the Bucks County Tax Map updated?

A: The Bucks County Tax Map is typically updated annually to reflect changes in property ownership, assessments, and other relevant information.

Q: Can I access the Bucks County Tax Map offline?

A: Yes, the Bucks County Assessment Office offers downloadable versions of the tax map in PDF format. You can also request physical paper copies of the map from the office.

Q: What if I cannot find my property on the Bucks County Tax Map?

A: If you are unable to locate your property on the map, it is advisable to contact the Bucks County Assessment Office directly. They can assist in resolving any discrepancies or providing additional information.

Q: How can I appeal my property tax assessment?

A: The Bucks County Assessment Office provides information and procedures for appealing property tax assessments. You can find detailed instructions on their website or contact them directly for assistance.

Tips for Utilizing the Bucks County Tax Map

- Familiarize yourself with the map’s features: Spend some time exploring the Bucks County Tax Map website to understand its functionalities and available information.

- Utilize the search options effectively: Choose the most appropriate search criteria to narrow down your search results and find the desired property quickly.

- Read property details carefully: Pay close attention to the information displayed for each property, including ownership, characteristics, and assessment data.

- Contact the Assessment Office for clarification: If you have any questions or need assistance in interpreting the map, do not hesitate to contact the Bucks County Assessment Office.

Conclusion

The Bucks County Tax Map is an invaluable resource for understanding the intricate landscape of property ownership and characteristics within the county. Its comprehensive data, accessible format, and user-friendly interface empower homeowners, buyers, developers, and government agencies to make informed decisions related to property. By leveraging the information provided by the Bucks County Tax Map, stakeholders can navigate the complexities of property ownership, understand potential limitations, and make informed choices for their property-related endeavors.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Landscape of Property: A Guide to Bucks County’s Tax Map. We hope you find this article informative and beneficial. See you in our next article!