Navigating Property in Berkeley County, WV: A Guide to the Tax Map

Related Articles: Navigating Property in Berkeley County, WV: A Guide to the Tax Map

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating Property in Berkeley County, WV: A Guide to the Tax Map. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating Property in Berkeley County, WV: A Guide to the Tax Map

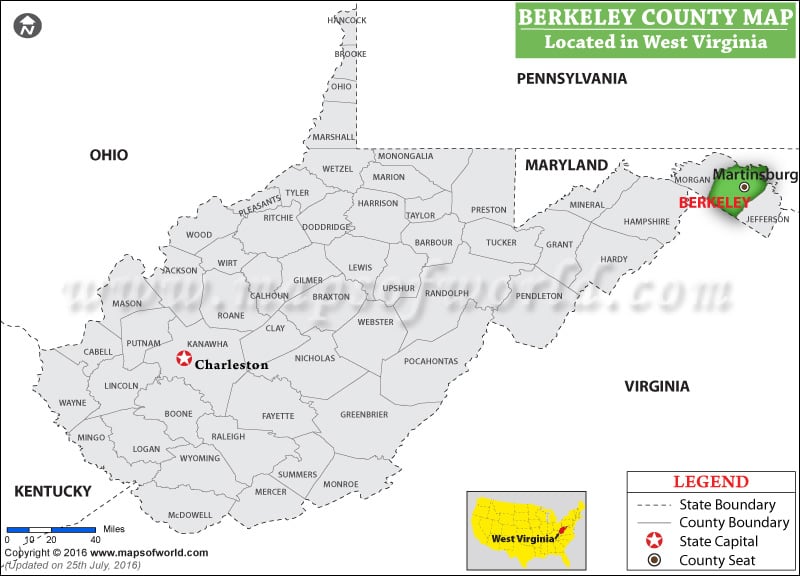

Berkeley County, West Virginia, is a vibrant community with a diverse landscape, encompassing bustling urban centers, tranquil rural areas, and picturesque landscapes. As with any dynamic region, understanding property ownership and its associated taxes is crucial for residents, businesses, and investors alike. The Berkeley County Tax Map serves as an invaluable tool in this regard, offering a comprehensive and accessible resource for navigating the intricacies of property ownership within the county.

Understanding the Berkeley County Tax Map

The Berkeley County Tax Map is a digital representation of the county’s geographical area, meticulously divided into parcels of land. Each parcel is assigned a unique identification number, known as the "tax map number," which acts as its digital fingerprint. These numbers are not randomly assigned; they follow a structured system that reflects the parcel’s location within the county, ensuring efficient organization and retrieval.

Key Features of the Berkeley County Tax Map:

- Visual Representation: The map provides a clear visual representation of property boundaries, allowing users to easily identify individual parcels and their relative locations.

- Detailed Information: Each parcel’s entry includes critical information such as its size, ownership details, and associated tax assessments. This information is crucial for property valuation, tax calculations, and legal documentation.

- Accessibility: The Berkeley County Tax Map is typically available online, offering convenient access for residents, businesses, and real estate professionals. This digital accessibility fosters transparency and simplifies property-related research.

- Transparency: The map’s public availability promotes transparency in property ownership and tax assessments, fostering accountability and trust within the community.

Applications of the Berkeley County Tax Map:

The Berkeley County Tax Map serves a multitude of purposes, proving invaluable to various stakeholders:

- Property Owners: The map allows owners to verify their property boundaries, identify adjacent parcels, and access their property tax assessments. This information is essential for managing property taxes, planning renovations, or considering potential sales.

- Real Estate Professionals: Real estate agents, brokers, and appraisers utilize the map to conduct property searches, assess property values, and identify potential investment opportunities. The map’s detailed information streamlines property research and facilitates informed decisions.

- Government Agencies: The Berkeley County Assessor’s Office relies on the tax map to maintain accurate property records, conduct property assessments, and administer tax collection. The map is also instrumental in planning and development initiatives, ensuring informed decisions regarding land use and infrastructure.

- Community Members: The map serves as a valuable resource for understanding the county’s land use patterns, identifying potential development projects, and engaging in community discussions regarding land management.

Accessing the Berkeley County Tax Map:

The Berkeley County Tax Map is typically accessible online through the Berkeley County Assessor’s Office website. The website may provide search functionality, allowing users to locate specific parcels by address, tax map number, or owner name. In some cases, the map may be available through external platforms, such as mapping websites or real estate portals.

Navigating the Map:

While the Berkeley County Tax Map is a user-friendly tool, some basic understanding of its features is necessary for effective navigation.

- Layers: The map may offer different layers of information, such as property boundaries, zoning regulations, and infrastructure details. Users can toggle these layers on and off to customize their view.

- Zoom Functionality: The map typically allows users to zoom in and out, providing a detailed view of specific areas or a broader perspective of the county.

- Search Options: Most maps offer search functionality, allowing users to locate parcels by entering their address, tax map number, or owner name.

FAQs Regarding the Berkeley County Tax Map:

Q: What information is available on the Berkeley County Tax Map?

A: The Berkeley County Tax Map typically provides information such as property boundaries, parcel identification numbers, ownership details, property size, and tax assessments.

Q: How can I access the Berkeley County Tax Map?

A: The map is typically available online through the Berkeley County Assessor’s Office website.

Q: What is the purpose of the tax map number?

A: The tax map number is a unique identifier assigned to each parcel of land, facilitating property identification and management.

Q: How are property taxes calculated?

A: Property taxes are calculated based on the assessed value of the property and the applicable tax rate. The assessed value is determined by the Berkeley County Assessor’s Office.

Q: What happens if I disagree with my property assessment?

A: Property owners have the right to appeal their property assessment if they believe it is inaccurate. The appeal process is typically outlined on the Berkeley County Assessor’s Office website.

Tips for Using the Berkeley County Tax Map:

- Familiarize yourself with the map’s features: Spend some time exploring the map’s interface and understanding its functionalities.

- Utilize search options: Leverage the search functionality to locate specific parcels efficiently.

- Explore different layers: Toggle different layers on and off to gain a comprehensive understanding of the information available.

- Contact the Assessor’s Office: If you have any questions or require assistance, contact the Berkeley County Assessor’s Office for guidance.

Conclusion:

The Berkeley County Tax Map serves as a vital tool for navigating property ownership within the county. Its comprehensive information, accessibility, and transparency foster informed decisions regarding property management, investment, and community development. By understanding the map’s features and functionalities, residents, businesses, and government agencies can leverage its valuable insights to navigate property-related matters effectively and contribute to the continued growth and prosperity of Berkeley County, West Virginia.

Closure

Thus, we hope this article has provided valuable insights into Navigating Property in Berkeley County, WV: A Guide to the Tax Map. We hope you find this article informative and beneficial. See you in our next article!